Annual Report 2021

Business performance

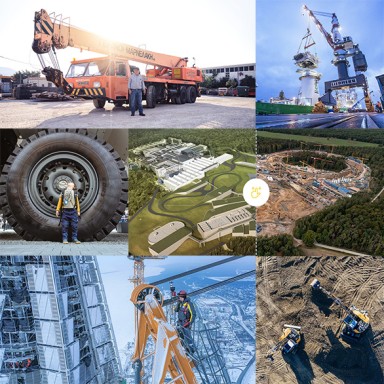

The Group in 2021

The Liebherr Group achieved a total turnover of € 11,639 million in 2021. This represents an increase of € 1,298 million or 12.6 %, compared with the previous year.

Turnover worldwide € m

Overall economic performance

According to the International Monetary Fund, the global economy grew by 5.9 % in 2021. However, the impact of the coronavirus pandemic continued to be felt in the form of travel restrictions, disruptions in global supply chains and interruptions in manufacturing activities worldwide. Other impacts included price increases in many areas and rapidly rising inflation rates in some countries. Nevertheless, there have been signs of a general upward trend, with growth of 5.0 % in industrialised countries and 6.5 % in emerging and developing countries. The US economy grew by 5.6 % while growth in the Eurozone reached 5.2 %. The World Trade Organisation reported a 10.8 % increase in international trade volume. However, this strong growth has been unevenly distributed, with some developing countries lagging significantly behind the global average.

With the exception of its gear technology and automation systems as well as maritime cranes, the Liebherr Group achieved significant growth in all product segments in the 2021 business year, almost on a par with the record growth it achieved in 2019. However, with the recovery of the global markets from the second quarter onwards, manufacturing companies have faced difficulties in procuring a wide range of raw materials, components and electronic parts. These shortages have been accompanied by price increases and bottlenecks in the global supply chains and logistics, which have also affected Liebherr’s production activities to varying degrees. Further challenges have arisen in the form of regional lockdowns and pandemic-related restrictions, such as travel bans.

Despite the difficult conditions in the global market, the Liebherr Group has performed extremely well. The Group recorded a turnover of € 8,009 million with construction and mining machines, representing a significant increase of 17.0 % over the previous year. This includes the product segments earthmoving, material handling technology, deep foundation machines, mining, mobile and crawler cranes, tower cranes and concrete technology. The product segments maritime cranes, aerospace and transportation systems, gear technology and automation systems, refrigerators and freezers, components and hotels achieved a total turnover of € 3,630 million, an increase of 3.9 % over the previous year.

Turnover performance by region

Total turnover 11,639 € m

+ 12.6 %+ 1,298 € m

| % the previous year | € the previous year | ||

|---|---|---|---|

| Asia and Oceania | 1,812 € m | + 10.6 | + 174 m |

| Africa, Near and Middle East | 574 € m | - 5.4 | - 33 m |

| Central and South America | 416 € m | + 34.6 | + 107 m |

| North America | 1,645 € m | + 13.6 | + 197 m |

| Non-EU countries | 1,536 € m | + 22.5 | + 282 m |

| European Union | 5,656 € m | + 11.2 | + 571 m |

The growth in turnover in the 2021 business year can be attributed to a strong performance in nearly all of Liebherr’s sales regions. In the European Union, traditionally Liebherr’s strongest market, turnover increased. High growth rates were recorded in almost all EU markets, with France in particular showing above-average development. Russia and the United Kingdom were the main drivers behind the strong growth in the non-EU countries. Positive development was also seen in North America. Growth in Central and South America was particularly strong, driven by a powerful growth impulse especially from Brazil. Only in Africa and the Near and Middle East did Liebherr face declines, while Asia and Oceania posted moderate growth.

Net result for the year

The Liebherr Group achieved a net result of € 545 million in 2021, which is above the pre-pandemic level. The operating result increased strongly compared to 2020 and the financial result also grew significantly.

Employees

49,611

+ 1,686

| Employees | Compared to the previous year | ||

|---|---|---|---|

| Asia and Oceania | 4,126 | + 226 | |

| Africa, Near and Middle East | 1,055 | + 22 | |

| Central and South America | 1,908 | + 145 | |

| North America | 1,898 | + 141 | |

| Non-EU countries | 4,964 | + 243 | |

| European Union | 35,660 | + 909 |

The employees are key to the success of the Liebherr Group. With their skills, commitment and passion for technology and fascinating products, they achieve outstanding results for the Group’s customers and play a pivotal role in shaping the company. As a family business, Liebherr is an employer with a strong tradition of partnership and teamwork based on reliability, fairness, respect and autonomy.

The Group’s workforce has grown over the past business year. At the end of 2021, Liebherr employed 49,611 people worldwide, an increase of 1,686 or 3.5 %. The number of employees rose most notably in Europe, followed by Asia and Oceania. However, the Group also saw an increase in their workforce in Central, South and North America, as well as in Africa and the Near and Middle East.

The Group continues to live up to its reputation as an attractive and reliable employer. Liebherr welcomed a large number of highly skilled new employees who will join the company on the path of digitalisation and contribute to technological progress. As such, the company is optimally positioned to undertake a wide range of innovative projects to drive forward the digital future in the years ahead.

Sustainability

The Group aspires to generate sustainable value for its employees, customers and suppliers and for society as a whole. As an independent family with a long-term focus, Liebherr is aware of its responsibilities and is committed to sustainable development. Its products, processes and infrastructure are geared to the minimum possible consumption of resources. The focus in all areas is on safety, efficiency and environmental sustainability. Last year, a large number of the Group’s companies worked on projects looking at social, environmental and economic aspects of sustainability. The many activities in these areas are to be incorporated into an overall concept for corporate responsibility, which is currently being developed at Group level.

Research and development

As a high-tech company, Liebherr aims to play a major role in advancing technological innovation. Last year, the company invested € 559 million in research and development activities. A large part of this spending was devoted to developing new products, as well as conducting numerous research projects in collaboration with universities, colleges and research institutes. The Group’s research activities continued to focus on digitalisation and the development of alternative drive systems. At the same time, Liebherr continued to develop existing technologies and add numerous new machines, components and solutions to its product portfolio.

In 2021, work continued on alternative drive concepts that will help reduce the ecological footprint of Liebherr products even further. Due to its diverse product portfolio with a wide variety of use cases, Liebherr is also pursuing a technology-open approach here. Last year, for example, Liebherr worked on solutions for hydrogenfuelled internal combustion engines and their injection technologies and adapted various product lines for using Hydrotreated Vegetable Oils (HVO) as fuel. Since September 2021, all mobile and crawler cranes produced at the Liebherr plant in Ehingen (Germany) are supplied by climate-neutral HVO instead of fossil diesel, making Liebherr the first crane manufacturer to take such a step. At the Liebherr plant in Kirchdorf an der Iller (Germany), HVO was phased in as the standard ex works fuel for Liebherr earthmoving and material handling machines starting in January 2022.

Numerous advances have also been made in the area of electric drive systems. Liebherr expanded its ETM series to include the first two fully electric truck mixers on a 5-axle chassis, and added two new models (the R 976-E and R 980 SME-E) to its range of electric crawler excavators. The company’s battery-powered, locally emissions-free crawler crane series was also expanded to include the LR 1160.1 unplugged and LR 1130.1 unplugged models. The first fully electric offshore crane from Liebherr is now also in development, bringing electric drive systems to yet another area of the company’s product portfolio.

This opens up new opportunities for gear technology as well: Liebherr has been working on new dry gear skiving technologies to meet the increasing demand for internally toothed gears for the drive systems in electric vehicles. In automation systems, product development was focused on automating processes for the production of e-vehicle battery systems. In addition to this, Liebherr and Airbus began a partnership to jointly develop the technologies for the fully hydrogen-powered Airbus ZeroE aircraft.

Digitalisation was another major focus of the Group’s activities. This included the launch of a new range of fully integrated appliances of refrigerators and freezers with resource-saving freshness technologies and digital networking. Existing technologies for remote control, automation and networking were also optimised in several product segments, and the Liebherr remote service app was expanded. Liebherr’s XpertAssist service combines multiple service tools, thus providing additional functionalities, and is available for crawler cranes, deep foundation machines and maritime cranes. In the area of mining trucks, Liebherr developed two new assistance systems which, among other things, include automatic steering support and reduce the workload of the driver as well as increase fuel efficiency.

Investments € m

Investments

The Liebherr Group has traditionally emphasised the importance of continual investments in its production facilities and its global sales and service network. Last year, investments totalled € 742 million, an increase of € 137 million or 22.6 % year-on-year. This was offset by depreciation amounting to € 507 million.

One focus of investment was the expansion and modernisation of company locations and the intensification of the Group’s global market presence.

In the concrete technology product segment, a new production plant went into operation: Liebherr-Concrete Technology Marica EOOD in Plovdiv (Bulgaria) supplies Liebherr-Mischtechnik GmbH in Bad Schussenried (Germany) with pre-assemblies and steel constructions for truck mixers. To further expand its presence in the Asian market and meet the high demand from the wind and construction industries, the Group began construction of a new components plant in China: Liebherr Components (Dalian) Co., Ltd. will produce slewing bearings, gearboxes and hydraulic cylinders at the Dalian site, starting at the end of 2022. Last year also saw the construction of a new assembly line for gearboxes in India. In addition, a largescale expansion was approved for the plant in Ehingen (Germany). Step-by-step investments will be made in the expansion until 2030 in order to significantly increase its production capacity and meet the rising demand for mobile and crawler cranes.

Depreciation € m

In parallel, the Group continued to expand its sales and service infrastructure. In Austria, new logistics centres were established in Telfs and Bischofshofen, and the building work on a new sales centre for construction machines started in Puch / Urstein. In Dettingen (Germany), Liebherr added a new office and repair facility to expand its sales and service infrastructure for construction machines. In addition, a new head office for Liebherr (China) Co., Ltd. has been established in Shanghai (China) and Liebherr's headquarters in Panama also underwent a major expansion.

Risk management system and internal control system

In order to ensure the sustainable success of the Group, opportunities and risks are identified at an early stage to be evaluated and controlled. The Group has a continually optimised risk management procedure in place, and an internal control system to help it meet operational, market-related and legal requirements.

To ensure the integrated recording, analysis and evaluation of risks, all managers responsible for the risk management and internal control systems used in the individual Group companies are involved. Risks are identified and assessed locally in the individual companies, then countermeasures to limit the risks are introduced and the impacts are evaluated.

This localised approach also makes it possible to identify and assess areas of opportunity efficiently. The information gained about market-related and technological developments is used in opportunities management to reach decisions about future areas of business and production processes.

At the corporate level, the current risk situation is regularly reviewed and the effectiveness of the systems and processes used is assessed. The internal audit department monitors compliance with Group guidelines and the implementation of the risk management and internal control systems.

Supplementary report

Events of particular significance which occur after the reporting date should be recorded here, along with their expected impact on the Group’s assets, financial position and earnings. There were no events of special significance within the Liebherr Group after the close of the 2021 business year.

Outlook for 2022

Before war broke out in Ukraine, the International Monetary Fund had forecast global economic growth of 4.4 % and gradually declining inflation if various factors such as the pandemic, supply-chain disruptions, the imbalance between supply and demand, and price and wage pressures were to recede.

Even if the effects of the war cannot yet be concretely assessed, serious economic consequences are already emerging, according to the International Monetary Fund. Rising energy and commodity prices are driving up inflation further, and the sanctions imposed on Russia will also have a significant impact on the global economy and financial markets.

The World Bank also expects the war and sanctions to have a significant economic impact on other countries as well.

According to the Euroconstruct research network, the European construction industry experienced a significant upturn of 5.6 % in 2021. For 2022, the industry was expected to expand by another 3.6 %, but this projection was made before the war in Ukraine began. Other factors, such as commodity prices and skilled labour shortages, could also inhibit growth.

The International Air Transport Association (IATA) expects further recovery in air traffic. In 2022, overall air traveller numbers are expected to be around 80 % of 2019 levels. This growth is expected to continue throughout the coming years. However, this forecast was also made before the start of the Russia-Ukraine conflict. Downward trends are expected in particular in markets that are directly affected by the war.

Liebherr is monitoring and assessing the current situation in Ukraine and Russia on a daily basis. The Liebherr Group is currently in the process of adjusting its Russian activities to the extensive sanctions imposed on the country. The medium‑term effects on business activities there are currently difficult to assess – but negative economic consequences are to be expected. The Liebherr Group has started 2022 with a very good order situation and is cautiously optimistic about the rest of the year despite the difficult conditions.

Individual opportunities and risks

To describe individual opportunities and risks, similar types of risks and opportunities have been grouped together.

Overall economic opportunities arise from the expected increase in demand in the various industrial sectors in which the Liebherr Group is active. Order intake is developing extremely positively across all product segments. At the same time, there are uncertainties with regard to how long pandemic-related restrictions will persist, the effects of steep price increases for many goods and services, shortages of certain raw materials and labour, and bottlenecks in various supply chains. It is still unclear how fiscal and monetary policy measures will ultimately affect the Liebherr Group. The war in Ukraine may also have a negative impact on the Group’s activities.

In terms of possible risks, the Group faces changes in costs as a result of these macroeconomic uncertainties, which cannot always be compensated for by price indexation. The sections on each of the product segments contain detailed reports on the relevant opportunities and risks. Market price risks could arise from the ongoing business operations, in particular from currency and interest rate fluctuations triggered by monetary policy measures.

Liebherr monitors these risks continuously and uses appropriate financial instruments to hedge selected transactions. The Group enters into financial transactions only where these are linked to its operational business activity or are for hedging purposes. On principle, Liebherr does not conduct transactions of a speculative nature.

The global nature of the business activities, together with a broadly diversified product base and the risk management system in place in the Group, ensure that the relevant risks are kept under control. Based on the currently available information, there are no further identifiable risks which could have a substantial detrimental effect on Liebherr’s assets, financial position and earnings in the 2022 business year and threaten the survival of the Group as a whole.

* Restatement first time adoption of IFRS 9 / 15 / 16