8 minutes reading time

China in focus

Over the past decades, China has undergone a remarkable transformation. Today, it is the world’s second-largest economy and remains on course for further growth. China is a significant market for the Liebherr Group – not just as a key sales market and production location. Armin Natter and Patrick Schulz, two managing directors at Liebherr (China) Co., Ltd., tell us why.

1

The words “Made in China” have become a mark of quality. What does this mean for the way the Liebherr Group views the Chinese market?

Armin Natter: There was a time when “Made in China” was mostly associated with low-cost mass production. But especially during the last 25 years, China has experienced extreme growth. Today, it is no longer known exclusively for its low-cost goods, but increasingly also for using new, efficient and sometimes even sustainable production technologies. It’s the world’s leader in communication and networking technologies, electromobility and alternative energies like wind and solar.

Patrick Schulz: “Made in China” is also becoming the global standard for future-forward technologies like 5G, artificial intelligence and robotics. China is not only interesting as a sales region and production location, but also as a market for technological development and resources. So, it’s no coincidence that the Liebherr Group has become more and more interested in China over the past few years. You can see that in our many activities and investments in the Chinese market, as well as in the strong growth in sales we’ve experienced there recently.

The importance of China for the Liebherr Group has increased gradually over the past few years. You can see that in our many activities and investments in the Chinese market, as well as in the strong growth in sales we’ve experienced there recently.

2

Which of Liebherr’s product segments currently benefits the most from the Chinese market?

Patrick Schulz: The Aerospace and Transportation Systems product segment definitely has the strongest potential for growth here. Within the next five years, China will be the world’s largest aircraft market. This will be a major advantage to our business if you consider the services we provide, such as maintenance, repairs and overhaul. We also see opportunities for becoming involved with new aircraft programmes like the single-aisle C919 or the ARJ21 regional jet. And China is already home to the world’s largest railway network, which is setting the standard for high-speed technologies.

It was also the largest market outside of Europe in 2020 for our Gear Technology and Automation Systems product segment. The wind energy and automotive industry were some of the main drivers behind that growth. And the demand for even more precise gear cutting machines is only going to increase as China starts producing more complex parts for electric motors in the future.

Armin Natter: The Components product segment is also on a course for growth in China. In 2020, China accounted for 56 percent of all newly installed onshore and offshore wind energy facilities, according to the Global Wind Energy Council. Our Components product segment is a key supplier for China’s wind power projects. We provide them with slewing bearings, slewing drives and hydraulic cylinders. These are used in rotor bearings and in the adjustment of rotor blades and nacelles. To keep up with the growing demand, we are expanding our own local capabilities there. In the near future we will be commissioning a new assembly line for hydraulic cylinders in Dalian, which are intended, among other things, for the wind industry. In addition, from Europe we supply our Chinese partners with fuel injection systems for large diesel engines, but we also produce components for construction machinery.

Our Earthmoving and Mining product segments also benefit from the positive prospects on the Chinese market. That’s because our machines are used in infrastructure projects as well as in raw material and energy extraction there. In Dalian, we are producing locally a selection of crawler excavators, wheel loaders and material handling machinery for the Chinese market as well as for export markets. We’ve also seen positive growth in sales of our Refrigeration and Freezing product segment in China. Traditionally, we’ve done well in China in our Mobile and Crawler Cranes, Concrete Technology and Maritime Cranes product segments, too.

3

The coronavirus pandemic brought many challenges which had a huge impact on 2020. How has business in China fared?

Armin Natter: China was very effective at implementing nuanced location-specific countermeasures. For example, the measures taken in Wuhan were completely different from the ones taken in Shanghai. Just two months into the pandemic, China was already beginning its economic recovery.

Patrick Schulz: The measures taken by the government mostly affected the first quarter of 2020. That’s the period around Chinese New Year, which is generally a slower time of year for the economy. Most of our product segments managed to increase their sales in China in 2020 compared with the year before. The only product segment that didn’t see an increase year-on-year due to the effects of the coronavirus pandemic was Aerospace and Transportation Systems. We expect that the economic recovery in this segment will be a lengthy process.

4

What were your highlights of the past business year in China?

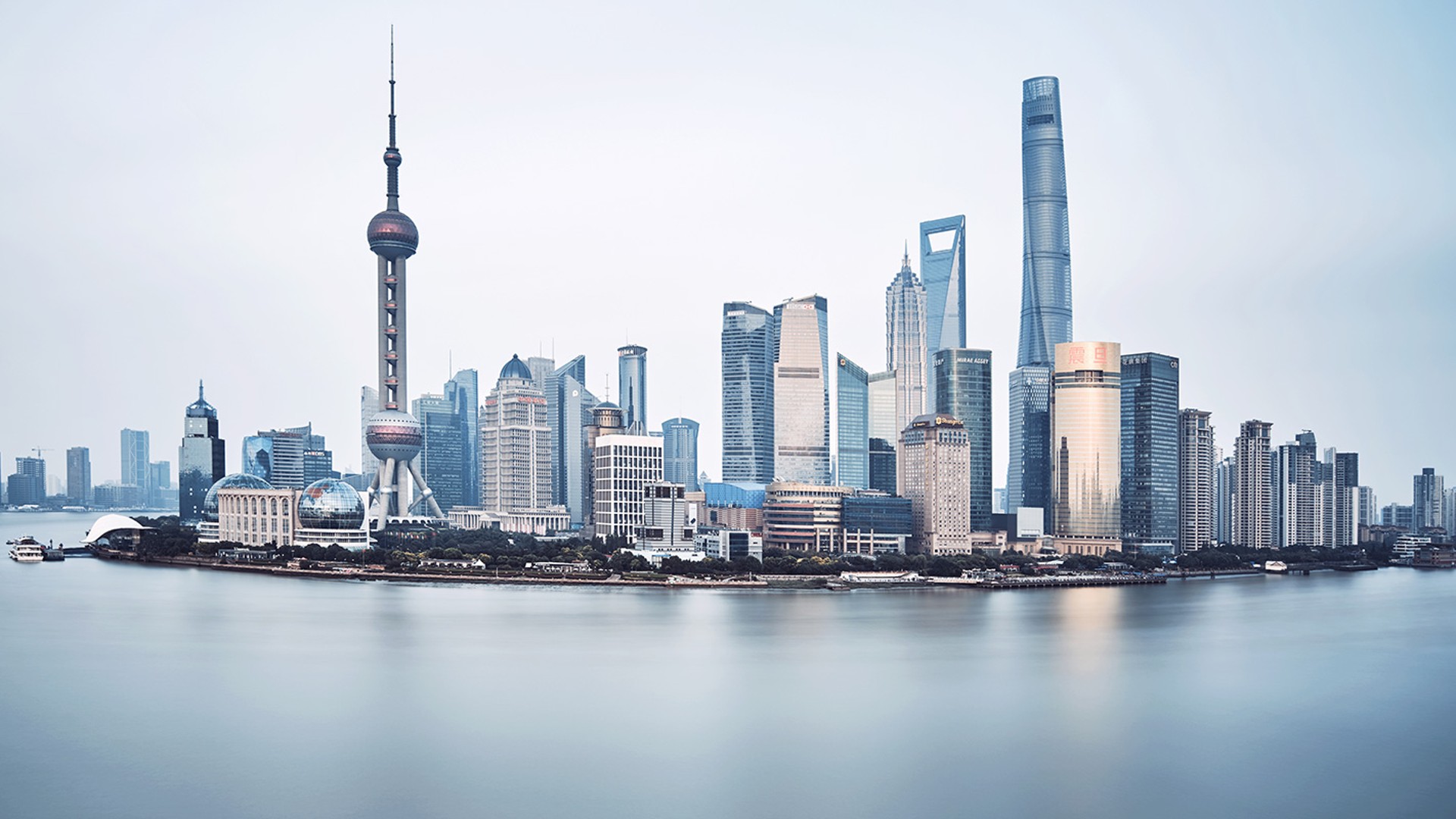

Patrick Schulz: Well, the construction of our new regional headquarters in Shanghai deserves special mention. We’re consolidating all our central areas and sales activities in China into an office space of 15,000 square metres. During the construction, all our repair facilities for the aerospace sector will be set up here and we’ll continue to expand them.

We’re also investing in additional production sites at the moment. Our Transportation Systems product segment is ratcheting up its current activities in China with a new plant in Pinghu. In the future, this will be a site for developing, producing and testing cutting-edge components for railway vehicles. Starting in 2022, a new production facility in Dalian will start producing components for the wind energy sector as well as for use in construction machinery and stationary applications. In the Concrete Technology product segment, we are working on building our local engineering expertise at our plant in Xuzhou and developing a mixing plant specifically for the Chinese market.

Armin Natter: Another highlight of the last year was when our R9150B E electric mining excavator won the Best Application Award at the T50 Construction Machinery Summit. The R9150B E is the best machine in its class. Electrification of mining machines is a priority for us, so we now offer the largest selection of electric-powered mining excavators on the market. We have also developed electric-powered machines specifically for the needs of industrial material handling.

New regional headquarter building in Shanghai

5

Liebherr has been active in China for over 40 years. Can you tell us what that’s been like?

Armin Natter: China’s open-door policy came into effect in 1978. That’s the year we began our operations there and opened our first field office in Beijing. But that policy did not immediately result in a market economy. Instead, reforms came step by step over a series of five-year plans. China was slowly opening up its economy to the rest of the world. So, until the end of the 1980s, Liebherr saw it primarily as a market for exports and licensing.

Patrick Schulz: Additional reforms in the 1990s made it possible for us to increasingly join in partnerships and joint ventures, where we primarily contributed our expertise in technology and management. Our first joint venture was founded in Xuzhou in 1996. We’re still producing truck mixers and mixing plants there today. In total, we operate five manufacturing companies in China and three sales and service companies.

The year 2000 was the first year in which China allowed foreign entities to incorporate independent, wholly owned subsidiaries there. After that, Liebherr founded the company that would later become Liebherr (China) Co., Ltd., which is responsible for our sales and customer service throughout the country. Over the past few decades, China has gone from being reluctant to engage with the outside world, to becoming a confident, ambitious global player. And now, its industrial policy strategies like Made in China 2025 and One Belt, One Road are setting the country on a course towards securing its economic independence. At Liebherr, we can look back on 40 years of successful presence in China, and we certainly look forward to continuing to play a role in this new phase of economic development.

China’s industrial policy strategies

With its Made in China 2025 strategy, China is gearing up to becoming an industrial power. To make this happen, the Chinese government is focusing on ten key industries, including: energy efficiency and electromobility, next-generation information and communications technologies, high-end manufacturing machinery and robotics, modern systems for railway travel, as well as aerospace equipment. The plan drew inspiration from the concept of a Fourth Industrial Revolution, or Industry 4.0, which originated in Germany.

The One Belt, One Road initiative involves a range of projects for expanding the intercontinental trade and infrastructure network between China and other countries in Asia, as well as in Africa and Europe. The plan is to develop mutual strategies for trade and for connecting and expanding existing infrastructure networks. This initiative is also referred to as the New Silk Road, which evokes the network of historical trade routes that once connected China and Europe in ancient and medieval times.

6

How will these industrial policy strategies influence Liebherr?

Armin Natter: The German concept of Industry 4.0 was one of the main inspirations behind the Made in China 2025 strategy. The Chinese want to become the world’s leading industrial superpower. Their telecoms providers are already among the most innovative in the world. Liebherr is already aligning itself with these developments. Today, we offer our customers in China a broad selection of automation systems for task monitoring, process logging, manufacturing analysis and production optimisation.

Patrick Schulz: The One Belt, One Road industrial policy strategy involves building a new trade network between Asia, Africa and Europe, a kind of new Silk Road. China sees this as a means of achieving greater independence from foreign influences. The plan starts with infrastructure projects, both inside and outside of China.

For us, that means an opportunity to take part in these projects with our construction machines. But even for investments made outside of China under the One Belt, One Road strategy, the Chinese government will still make most of the decisions. So, our local presence will continue to be indispensable, as it always has been, for securing our involvement in these projects and being able to take part as the strategy continues to unfold.

At the same time, the One Belt, One Road strategy also means that we’ll be competing against Chinese companies more often in the future, even outside of China. But our customers will continue to benefit from our global service network, with local staff and replacement parts.

China’s growth is an opportunity as well as a challenge for the Liebherr Group: We need not only be a trusted partner to our customers during this growth phase – we also have to convince them of our highly competitive technologies and innovations.

7

What do you think 2021 has in store for Liebherr in China?

Armin Natter: In general, we’re very optimistic about how each of our product segments will continue to grow in China. The International Monetary Fund has predicted global growth of 5.5 percent. In China, growth is at 8.1 percent, which is far above the average. This growth is primarily quality-driven and fuelled by the development of new technologies, as well as modern trends like digitalisation, green energy and smart manufacturing.

China’s growth is an opportunity as well as a challenge for the Liebherr Group. We need not only be a trusted partner to our customers during this growth phase – we also have to convince them that we are leading the way on key trends with our highly competitive technologies and innovations.

Thank you very much for your time and for your interesting insights into the Chinese market!